So I spent the weekend teaching myself about technology.

Google never ceases to impress me.

If investing on your own is something you've taken a shine to, you might be interested in the link below.

Add gadgets to your homepage

If you're not interested in investing, I'd still recommend investing in yourself to learn about all of the great gadgets, widgets, and entertainment that Google has to offer.

Beautiful!

Now, I better go learn more about investing! After last week's performance.......

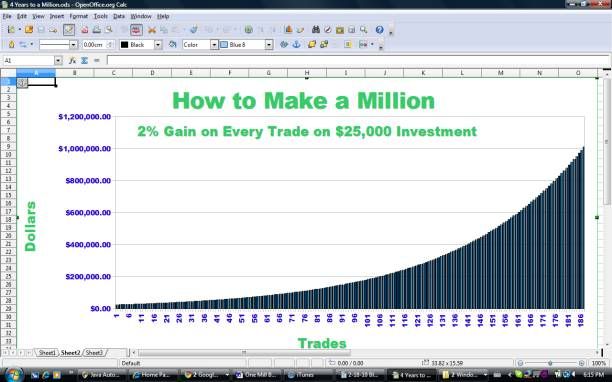

I'm on a mission to make a million by investing $25,000 in one company at a time. I'm gonna sell the company every time it logs a 2% gain from the purchase price. It'll take 187 trades to get to a million.

Total Pageviews

Sunday, October 31, 2010

Saturday, October 30, 2010

Trade 1 of 187 on my Quest to Invest to a Million

Well, looks like my speculation didn't ring true. Chevron's earnings announcement disappointed,the primary reason being cited as a weekend US dollar.

http://www.reuters.com/article/idUKTRE69S1IS20101029?type=companyNews

Three things I'd like to highlight at the end of week one - Emotions, Hedging, and Timing.

My emotions are down right now. I feel tempted to sell because I think the momentum in this space is down. If I sell, I'll have to make a 5% gain to get to where I want to be. So do I take one step forward and two steps back, or do I do nothing? Do I think the share price will recover quicker in CVX than something else?

This leads to the topic of hedging.

http://www.investopedia.com/terms/h/hedge.asp

Making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

My hedge here is the fact that the stock was purchased in US dollars. Oil and US dollars have an inverse relationship, so if the price of oil goes downs, and takes the price of the oil company (Chevron, NYSE: CVX) with it, than there might be some redemption if the US dollar goes up.

The purchase price of the stock was $84.93. The Canadian Exchange rate on the date of purchase was 1.03400.

Today the purchase price of the stock is $82.60. The Canadian Exchange rate today is 1.0188. Double whammy.

http://www.google.com/finance?q=cvx

This means my purchase price was $87.82. The value of one share of the stock today is $83.57. I'm down 4.8%.

Timing. Do I think I can make 5% in CVX, or is there a better opportunity out there? This isn't about having a vested interested in CVX.

I'm gonna hold for now. My 187 trades might take 187 years, but hopefully not:)

What's your vote: hold or sell? Help me make my decision by commenting.

http://www.reuters.com/article/idUKTRE69S1IS20101029?type=companyNews

Three things I'd like to highlight at the end of week one - Emotions, Hedging, and Timing.

My emotions are down right now. I feel tempted to sell because I think the momentum in this space is down. If I sell, I'll have to make a 5% gain to get to where I want to be. So do I take one step forward and two steps back, or do I do nothing? Do I think the share price will recover quicker in CVX than something else?

This leads to the topic of hedging.

http://www.investopedia.com/terms/h/hedge.asp

Making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

My hedge here is the fact that the stock was purchased in US dollars. Oil and US dollars have an inverse relationship, so if the price of oil goes downs, and takes the price of the oil company (Chevron, NYSE: CVX) with it, than there might be some redemption if the US dollar goes up.

The purchase price of the stock was $84.93. The Canadian Exchange rate on the date of purchase was 1.03400.

Today the purchase price of the stock is $82.60. The Canadian Exchange rate today is 1.0188. Double whammy.

http://www.google.com/finance?q=cvx

This means my purchase price was $87.82. The value of one share of the stock today is $83.57. I'm down 4.8%.

Timing. Do I think I can make 5% in CVX, or is there a better opportunity out there? This isn't about having a vested interested in CVX.

I'm gonna hold for now. My 187 trades might take 187 years, but hopefully not:)

What's your vote: hold or sell? Help me make my decision by commenting.

Wednesday, October 27, 2010

Trade 1 of 187 on my quest for a million

Wwwwwaaaaahhhhhhhh!!!

Chevron was down 0.99% today. Boooooooooooooo.

I'm not too worried about this temporary set back. The word on the street is that there's worry in the US that the Feds efforts to stimulate the economy may not be effective.

This doesn't really concern me. It's certainly not new news.

I'm gonna bet this rallies back 1.5% tomorrow, and then continues to rise on speculation or actual earnings announcements.

Chevron was down 0.99% today. Boooooooooooooo.

I'm not too worried about this temporary set back. The word on the street is that there's worry in the US that the Feds efforts to stimulate the economy may not be effective.

This doesn't really concern me. It's certainly not new news.

I'm gonna bet this rallies back 1.5% tomorrow, and then continues to rise on speculation or actual earnings announcements.

Tuesday, October 26, 2010

Do It Yourself Investing to a Million: Trade 1 of 187

Monday, October 25, 2010

My Quest to Make A Million Dollars in 187 Trades: 1st Trade

Step 1 of 187, buy the first company that is going to make me a 2% return - Chevron (NYSE: CVX. I should mention that I hope to make my 2% gain in a week or less. Yes, I'm an eternal optimist.

I bought 286 shares at a price of $87.8164 per share for a grand total of $25,115.48. The prices here are in Canadian dollars, and you'll note they're different than the prices listed on the charts. The difference is due to the value of the Canadian dollar versus the US dollar at the time the purchase was ordered.

I use CIBC Investor's Edge (https://www.investorsedge.cibc.com/ie/home.jsp)to do my trading. Each buy costs $28.95 and each sell costs $28.95. I've factored this into my million dollar formula.

Read more info about Chevron at:

http://en.wikipedia.org/wiki/Chevron_Corporation

All publicly traded companies have an investor relations site. For Chevron, this is:

http://investor.chevron.com/phoenix.zhtml?c=130102&p=irol-irhome

The chart for today's performance can be viewed at:

http://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1288062504066&chddm=46920&chddi=86400&chls=CandleStick&q=NYSE:CVX&&fct=big

The share price opened today higher than it closed on Friday, and finished the day pretty much flat. What I'm hoping for here is that the speculation about Q3 earnings to be announced on Friday, the 29th drive the share price up 2% this week.

I'm inspired by the fact that, of the three big oils announcing earnings this week: Chevron (NYSE: CVX), Exxon Mobil (NYSE: XOM), and Conoco Phillips (NYSE: COP), Chevron is the only company that posted a gain in share price today. Let's hope this is an indicator of the performance of the stock in the week ahead.

I bought 286 shares at a price of $87.8164 per share for a grand total of $25,115.48. The prices here are in Canadian dollars, and you'll note they're different than the prices listed on the charts. The difference is due to the value of the Canadian dollar versus the US dollar at the time the purchase was ordered.

I use CIBC Investor's Edge (https://www.investorsedge.cibc.com/ie/home.jsp)to do my trading. Each buy costs $28.95 and each sell costs $28.95. I've factored this into my million dollar formula.

Read more info about Chevron at:

http://en.wikipedia.org/wiki/Chevron_Corporation

All publicly traded companies have an investor relations site. For Chevron, this is:

http://investor.chevron.com/phoenix.zhtml?c=130102&p=irol-irhome

The chart for today's performance can be viewed at:

http://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1288062504066&chddm=46920&chddi=86400&chls=CandleStick&q=NYSE:CVX&&fct=big

The share price opened today higher than it closed on Friday, and finished the day pretty much flat. What I'm hoping for here is that the speculation about Q3 earnings to be announced on Friday, the 29th drive the share price up 2% this week.

I'm inspired by the fact that, of the three big oils announcing earnings this week: Chevron (NYSE: CVX), Exxon Mobil (NYSE: XOM), and Conoco Phillips (NYSE: COP), Chevron is the only company that posted a gain in share price today. Let's hope this is an indicator of the performance of the stock in the week ahead.

Sunday, October 24, 2010

My Quest to Make A Million Dollars in 187 Trades

My Quest to Invest to a Million

I’m starting a new project today, and I have to admit I’m really pumped about it. The goal is to make a million dollars before I turn 40. I’m a retail investor – I buy and sell stocks for my personal account, and not for any company or organization. I love business news, trend watching, and looking at data to make decisions. I love setting goals, and get really excited working to accomplish something.

Thus, my simple project. I’m gonna take $25,000, and invest it in one company at a time. Every time I gain 2% on the stock that I’ve invested in, I’m gonna sell it. All I have to do is buy a stock, gain 2%, sell, and repeat 187 times. It’s that simple.

I’ll be blogging the project along the way, telling you my stock picks, why I’m choosing to buy them, including screen shots and links to the charts and news that I’m using to make my decisions.

My first pick is Chevron (CVX). I think I can make a 2% gain on it pretty quick. The company is announcing earnings this week, http://articles.moneycentral.msn.com/Investing/Dispatch/market-dispatches.aspx?post=fe94e62b-68ae-4289-b037-c34abf18e68c the 5 day, and the 1 month, charts indicate that the company has been having a good quarter.

CVX to Announce Third Quarter Earnings This Week http://articles.moneycentral.msn.com/Investing/Dispatch/market-dispatches.aspx?post=fe94e62b-68ae-4289-b037-c34abf18e68c

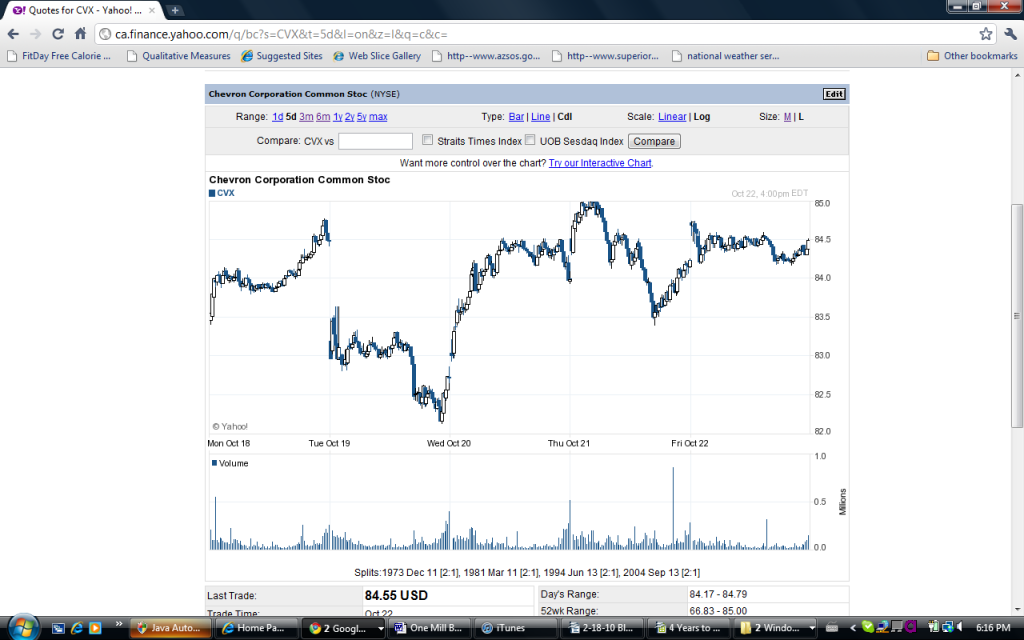

5 Day Candlestick Chart for CVX http://ca.finance.yahoo.com/q/bc?s=CVX&t=5d&l=on&z=l&q=c&c=

There may be some psychological resistance at $85, but I think the potential and speculation for the company to exceed analyst expectations in their earnings announcement will “trump” the resistance. The price is trending up. The share price for the week of October 18th ranged from $83.14 - $85.

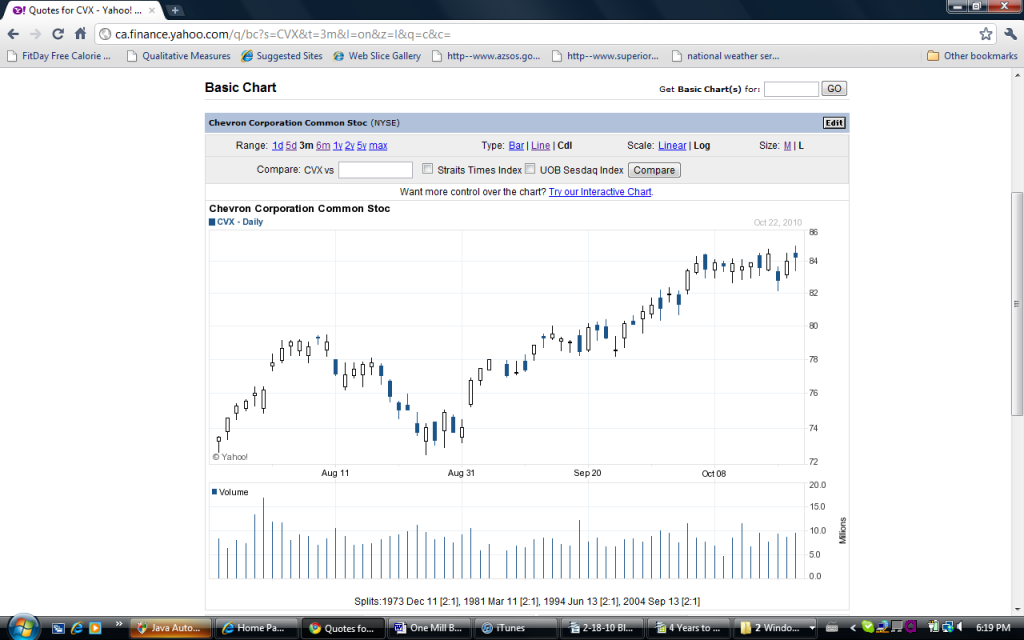

3 Month Candlestick Chart for CVX http://ca.finance.yahoo.com/q/bc?s=CVX&t=3m&l=on&z=l&q=c&c=

The share price has been climbing consistently since the end of August. This suggests that the earnings announcement will be positive this week.

Now that I decided to make this buy, I better start looking for the next one to make my next 2%.

I’m starting a new project today, and I have to admit I’m really pumped about it. The goal is to make a million dollars before I turn 40. I’m a retail investor – I buy and sell stocks for my personal account, and not for any company or organization. I love business news, trend watching, and looking at data to make decisions. I love setting goals, and get really excited working to accomplish something.

Thus, my simple project. I’m gonna take $25,000, and invest it in one company at a time. Every time I gain 2% on the stock that I’ve invested in, I’m gonna sell it. All I have to do is buy a stock, gain 2%, sell, and repeat 187 times. It’s that simple.

I’ll be blogging the project along the way, telling you my stock picks, why I’m choosing to buy them, including screen shots and links to the charts and news that I’m using to make my decisions.

My first pick is Chevron (CVX). I think I can make a 2% gain on it pretty quick. The company is announcing earnings this week, http://articles.moneycentral.msn.com/Investing/Dispatch/market-dispatches.aspx?post=fe94e62b-68ae-4289-b037-c34abf18e68c the 5 day, and the 1 month, charts indicate that the company has been having a good quarter.

CVX to Announce Third Quarter Earnings This Week http://articles.moneycentral.msn.com/Investing/Dispatch/market-dispatches.aspx?post=fe94e62b-68ae-4289-b037-c34abf18e68c

5 Day Candlestick Chart for CVX http://ca.finance.yahoo.com/q/bc?s=CVX&t=5d&l=on&z=l&q=c&c=

There may be some psychological resistance at $85, but I think the potential and speculation for the company to exceed analyst expectations in their earnings announcement will “trump” the resistance. The price is trending up. The share price for the week of October 18th ranged from $83.14 - $85.

3 Month Candlestick Chart for CVX http://ca.finance.yahoo.com/q/bc?s=CVX&t=3m&l=on&z=l&q=c&c=

The share price has been climbing consistently since the end of August. This suggests that the earnings announcement will be positive this week.

Now that I decided to make this buy, I better start looking for the next one to make my next 2%.

Subscribe to:

Posts (Atom)